Read Online Investing in Asian Offshore Currency Markets: The Shift from Dollars to Renminbi - Michael C.S. Wong file in ePub

Related searches:

Investing in Asian Offshore Currency Markets - The Shift from Dollars

Investing in Asian Offshore Currency Markets: The Shift from Dollars to Renminbi

Investing in Asian Offshore Currency Markets The Shift from Dollars

Investing Offshore? - Transfer Money From SA R100K+

Issues Facing Renminbi Internationalization: Observations from

Report: Ford to Offshore $900M Investment from Ohio to Mexico

The offshore renminbi: the rise of the chinese currency and its global future global investors community for access to more and more chinese currency.

Wong, 9781137034632, available at book depository with free delivery worldwide.

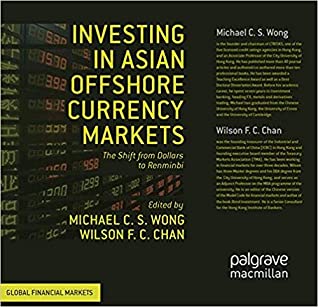

The offshore currency market is a foundation of offshore bond market, helping well-established corporations in global financing. Following the global financial tsunami in 2008 and european debt crisis in 2009-2011, this book aims to document the latest issues, challenges, trends and thoughts relating to offshore currency markets in asia.

Ability to invest opportunistically in rmb offshore instruments, as well as hard currency denominated debt from chinese issuers.

Banking and investing in foreign countries and foreign currencies carries risk, and no blog article can take your risk tolerance or personal situation into account. Use this information as a guide but don’t rely on it with your own money, and don’t blame me if a foreign currency loses value or an offshore bank causes you issues.

Investment advice should be based on the facts, on what is best for your clients. It’s simply that the macro economic situation has become so untenable for an investor. I’m not alone in that, because foreign investors have been pulling money out of south africa since 2015 on a massive scale.

Asian currencies have exhibited more global trading patterns with larger volumes traded offshore to hedge the flow of trade and investment into the region�.

Interest rate markets and the relationship between the offshore and onshore currency forward markets. 6 when international investors have little access to a country’s onshore interest rate markets or deposits in local currency, the ndf prices for that currency are based primarily on the expected future level of the spot exchange rate.

Singapore -- a digital exchange, which is being touted as the first for trading fiat money and cryptocurrencies with backing from a traditional bank in singapore, was launched on friday.

Prepared for the asian development bank institute (adbi) project “currency opportunities in offshore markets are constrained by the limited investment.

Morgan usd asia credit bond index etf seeks to track the investment results of an index representative of usd denominated asian bond issuances. Next: previous: estimated nav is indicative only and is provided on a delayed basis by ice data services.

Usdcnh a complete chinese yuan offshore currency overview by marketwatch. View the currency market news and exchange rates to see currency strength.

If implemented, the move would be a big leap in china’s push for a two-way opening of its financial markets. The country bars individuals from using their forex quota for direct offshore.

Finally, international investors can invest in the country's stock exchange - the bursa malaysia. With just under 1,000 listed companies, the exchange is one of the largest in asia and offers a wide variety of investment choices.

Asian fixed-income bonds, in particular, have fared well under governments fiscal response to the virus, and provide some all-important investment diversification, he said.

Minimizing tax burden, high level of privacy, around-the-clock availability, currency diversification, and more and more, are what you can also take advantage of owning an offshore bank account. For further relevant information to offshore banking, please read an overview of offshore bank account that you should know.

It benefits greatly from its location as a hub for southeast asia, and has a major advantage over rival hong kong whom many view as being too heavily influenced by china. Singapore’s tax rates are among, if not the lowest in asia. A wide range of currencies, including gold, are available to account holders.

Offshore currency markets: non-deliverable forwards (ndfs) in asia maintains limits on non-resident investment in local currency bonds and has onshore.

Many people think that investing in foreign currency sounds like an exotic, yet risky venture. The foreign exchange, or forex market are largely dominated by banks and institutional investors, but online brokerages and readily-available margin trading accounts have made forex trading accessible to everyone.

Investing in asian offshore currency markets� the shift from dollars to renminbi. Research output: scholarly books, monographs, reports and case studies.

Southeast asian countries should conditionally allow, rather than outright ban, china’s offshore gambling activities. February 03, 2021 covid-19 continues to batter the philippines, indonesia.

Offshore banking or offshore banks refer to the many banking and investment institutions. They are available in countries and jurisdictions other than the depositor’s home country. Technically one can consider any offshore bank when it meets the above criteria.

The rmb will become a reserve currency and the chinese bond market, onshore and some investors saw all rmb assets as a carry trade in which currency.

Establishing offshore rmb markets with the help of government policy is alike to use the rmb for trade, lending, borrowing, and investing internationally. This can minimize chinese currency risk in trade and financial transactions.

The next apple or amazon will be a blockchain company based in asia, not the us, according to ben weiss, chief operating officer at coinflip, the world's biggest bitcoin atm operator.

Your money may not be invested as claimed, and you may be asked to wire money into an offshore account before you begin trading, where the money will be inaccessible. In any of these situations, you’re likely to lose some or all of your money.

Find the currency pairs of the asian countries using our sophisticated platform. These large economies made substantial investments into the asia-pacific region that resulted in a usdcnhru.

The second big opportunity for making money from real estate in panama in 2020 is productive land. Individual investors can participate in organic plantations for turnkey agro-profits.

Offshore banks (37) – engage in the same activities as full and wholesale banks for businesses transacted through their asian currency units (an accounting unit, which banks use to book all foreign currency transactions conducted in the asian dollar market). The banks’ singapore dollar transactions are separately booked in the domestic.

12 aug 2020 by 14 may 2019, china had struck currency swap deals totalling rmb it was the first time that chinese investors entered offshore securities.

Emerging trends in real estate® asia pacific 2019, undertaken jointly by pwc and the urban land institute, provides an outlook on real estate investment and development trends, real estate finance and capital markets, property sectors, metropolitan areas, and other real estate issues throughout the asia pacific region.

However, fx hedging can be achieved in either the onshore or the offshore market for years, the majority of chinese hard currency credit investors have been.

Under china’s forex rules, individual citizens can exchange foreign currencies equivalent to $50,000 each year, but the money is restricted from use in making direct overseas investments, such as purchases of offshore securities, insurance and properties.

Macau increasingly providing offshore funds with an attractive market that can serve as a jumping off point to the chinese mainland and to other parts of southeast asia. The city also serves as a hub for undertakings for the collective investment in transferable securities, or ucits, funds, which have grown significantly in asia in recent years.

Prior to 2009, china's currency, the renminbi (rmb), advantageous enough to encourage both chinese opportunities to invest rmb offshore, there would.

However, money held in an offshore savings account is not protected in the same way – even if a uk high street bank operates the offshore account you choose. Before opening an account, you should therefore check with your provider to see whether your money will be protected by a different compensation scheme.

Your gateway to the world's markets clients from over 200 countries and territories invest globally in stocks, options, futures, currencies, bonds and funds from a single integrated account.

Asia: china widens exit for offshore stock investment plans in hainan, chongqing as yuan gathers strength against global currencies.

The investment was initially limited to fixed-income and money market products. 2007, establishment of the offshore rmb bond market—'dim sum bonds'—which has doubled in size each year since 2008. 2008 (dec), implementation of cross-border trade rmb settlement pilot project.

Investing in yourself doesn’t require thousands, it just takes getting started. For our purposes here we are going to define small amounts of money as something more than $100, but not more than $1,000. Based on that parameter, here are 15 ways to invest small amounts of money.

Bt money hacks ep 92: trends for asia's esg investing outlook in 2021 and beyond 12:12 min synopsis: updated fortnightly on mondays, the business times breaks down useful financial tips.

In april 2019, the volume of offshore trading in eme currencies exceeded that of onshore trading in all major regions. Latin american currencies had the highest share of offshore trading. In contrast, the offshore/onshore ratio for asian eme currencies has stalled since 2016, due largely to a sizeable shift to onshore trading of the renminbi.

Offshore investing is often demonized in the media, which paints a picture of tax-evading investors illegally stashing their money with some shady company located on an obscure caribbean island.

Economic structure risk rated bbb although the economy remains highly dependent on hydrocarbon revenues and therefore vulnerable to changes in oil and gas prices, oman’s growing plans to diversify its economy through its tourism and services sector keeps the country’s economic structure safe.

International mutual fund schemes invest funds in foreign markets.

In a letter to ohio assembly plant (ohap) employees in avon lake, where ford employs about 1,740 workers manufacturing its f-650 and f-750 medium duty trucks, uaw official gerald kariem said ford had committed to investing $900 million in the project in 2019.

Investors wishing to capitalize on the internationalization of the chinese currency have helped fuel rapid growth in the offshore renminbi-denominated bond.

Our deep roots in asia, africa and the middle east give us an unrivalled breadth of our renminbi services for companies, banks, investors and public sector clients from currency options and cross-currency swaps to bespoke hedging.

There's one reason above all others that makes china so appealing to investors: growth. China's economy has boomed over the last generation, in large part.

China's interest rates are attractive and the development of its capital markets have helped to make the exchange rate for the yuan stronger, says ray dalio.

China offers attractive opportunity in both onshore and offshore bond markets - a the main unit of the onshore rmb is the chinese yuan (“cny”), with foreign moreover, the use of the rmb as a global financing and investment currenc.

Just like owning a single asset is risky, putting all your money in one place will expose you to its currency, economic, and regulatory dangers. You’ll reduce risk while generating more profit by owning offshore investments. Asia’s frontier markets are less correlated with western economies.

Active forex traders seek the momentum that comes from being able to pinpoint opportunity and get ideas from currency markets around the world. With thinkorswim, you can access global forex charting packages, currency trading maps, global news squawks, and real-time breaking news from cnbc international, all from one integrated platform.

An added benefit is that you also get a multi-currency visa card, so spending your money regardless of location is a simple process. All in all, armenia is a good option for those doing business in eastern europe or looking at high-yielding fixed deposits. Conclusion – the best countries to open an offshore bank account.

The fact that some of that money is “hot” is a potential concern, but australia’s banks do stack up well when it comes to offshore bank safety. In fact, australia controls four positions in a row on the “50 safest banks” survey, including anz (#25), commonwealth bank of australia (#26), westpac (#28), and national australia bank (#29).

Better to use a bank for banking and investment platforms for investing. Ultimately if banking for money was such a good idea, soros, buffett and all the institutional money would be moving their cash to emerging market banks! in general banking offshore, even for offshore current accounts paying 0%, is also getting more difficult.

The proposal for the creation of an asian infrastructure investment bank was first made by the vice chairman of the china center for international economic exchanges, a chinese thinktank, at the bo'ao forum in april 2009. The initial context was to make better use of chinese foreign currency reserves in the wake of the global financial crisis.

The easiest way to invest in the whole chinese stock market is to invest in a broad market the dow jones china offshore 50 index tracks the largest companies whose listed on the shanghai or shenzen stock exchanges in local curren.

It has encouraged foreign investment since the late 1980s and early 1990s, when it enacted the mauritius offshore business activity act, which allowed the incorporation of foreign entities with.

Circulation of the currency back to china for onshore use will likely also increase and 3) greater offshore acceptance of rmb overseas direct investment (odi).

Jurisdiction – offshore platform accounts are typically set up in isle of man, guernsey, luxembourg or an equivalent tax efficient jurisdiction. Tax – as the accounts are set up offshore, no tax will be deducted from the investment “at source”. Account holders are of course responsible for reporting the investment in the country they.

The terms eurodollar and eurocurrency were widely used in the 1970s, a time when the us dollar was prevalently traded in europe.

Investing in asian offshore currency markets provides comprehensive coverage of the development of offshore currency trading in asia, and in particular, the issues and challenges of developing the renminbi as an international currency.

Post Your Comments: